The Petron Malaysia Refining & Marketing Bhd (KLSE:PETRONM) Analyst Just Boosted Their Forecasts By A Sizeable Amount

Shareholders in Petron Malaysia Refining & Marketing Bhd (KLSE:PETRONM) may be thrilled to learn that the covering analyst has just delivered a major upgrade to their near-term forecasts. The consensus statutory numbers for both revenue and earnings per share (EPS) increased, with their view clearly much more bullish on the company's business prospects.

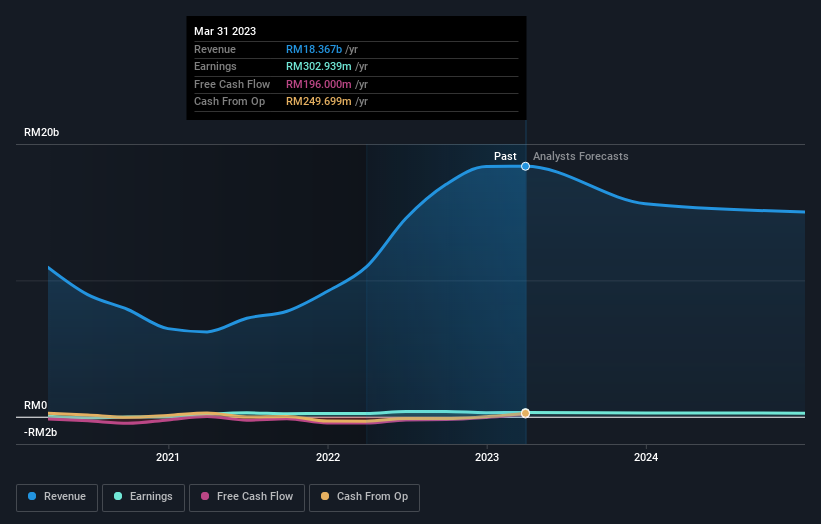

Following the upgrade, the consensus from lone analyst covering Petron Malaysia Refining & Marketing Bhd is for revenues of RM16b in 2023, implying a not inconsiderable 15% decline in sales compared to the last 12 months. Statutory earnings per share are supposed to reduce 8.2% to RM1.03 in the same period. Before this latest update, the analyst had been forecasting revenues of RM14b and earnings per share (EPS) of RM0.82 in 2023. There has definitely been an improvement in perception recently, with the analyst substantially increasing both their earnings and revenue estimates.

See our latest analysis for Petron Malaysia Refining & Marketing Bhd

It will come as no surprise to learn that the analyst has increased their price target for Petron Malaysia Refining & Marketing Bhd 6.9% to RM4.65 on the back of these upgrades.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. These estimates imply that sales are expected to slow, with a forecast annualised revenue decline of 15% by the end of 2023. This indicates a significant reduction from annual growth of 6.5% over the last five years. By contrast, our data suggests that other companies (with analyst coverage) in the industry are forecast to see their revenue decline 3.1% annually for the foreseeable future. So it's pretty clear that Petron Malaysia Refining & Marketing Bhd's revenues are expected to shrink faster than the wider industry.

The Bottom Line

The most important thing to take away from this upgrade is that the analyst upgraded their earnings per share estimates for this year, expecting improving business conditions. Notably, the analyst also upgraded their revenue estimates, with sales performing well although Petron Malaysia Refining & Marketing Bhd's revenue growth is expected to trail that of the wider market. Given that the consensus looks almost universally bullish, with a substantial increase to forecasts and a higher price target, Petron Malaysia Refining & Marketing Bhd could be worth investigating further.

Still, the long-term prospects of the business are much more relevant than next year's earnings. At least one analyst has provided forecasts out to 2024, which can be seen for free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here